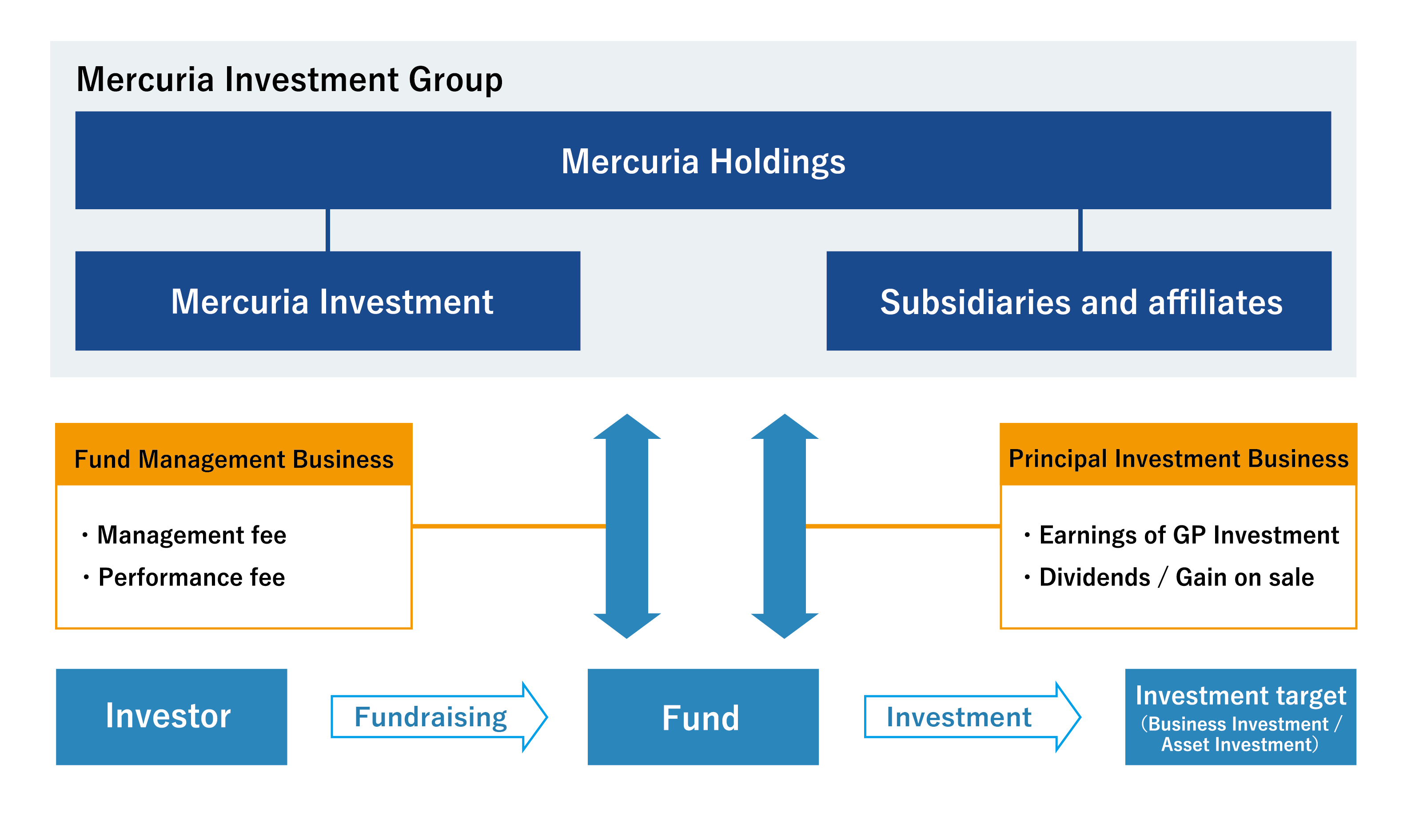

Focusing on business opportunities that extend beyond nations, regions and established frameworks, Mercuria Investment Group forms funds mainly through Mercuria Investment Co., Ltd., which is the core entity of the group. The Group invites mainly institutional investors in Japan and overseas to invest in these funds, and a team dedicated to each fund is responsible for end-to-end fund management including selecting attractive investees, executing, managing and exiting investments.

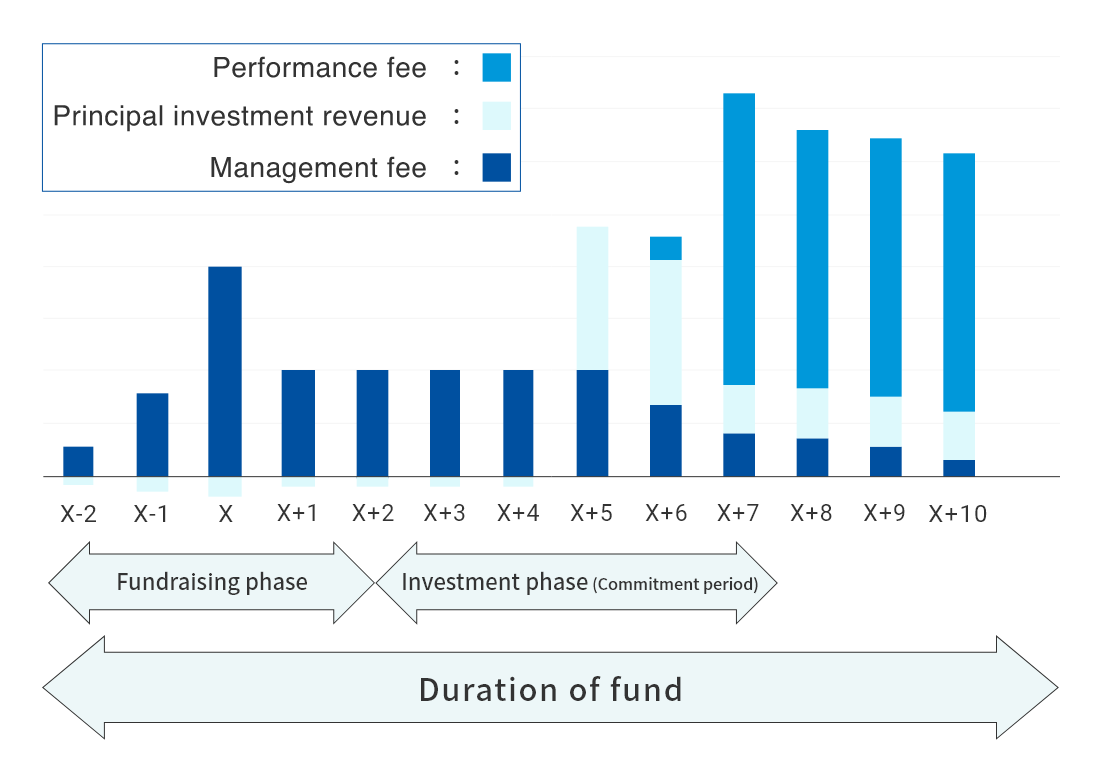

Mercuria Investment Group invests mainly in alternative assets. Alternative assets have low liquidity and are, therefore, held long term, with 3-5 years as a benchmark. During this period, we and the other fund managers undertake activities such as enhancing the value of investees and managing cash flows. As a result, investments in alternative assets can be expected to yield greater returns than so-called traditional asset classes (domestic and foreign stocks, domestic and foreign bonds) and this is an area that has been attracting attention among institutional investors as a new investment target in recent years.