Mercuria Holdings

Our Feature

ONLY

1

We are the only listed Group focusing on alternative investment in Japan*

As of the end of December 2023, JPEA had a total of 62 regular members. Of these, Mercuria Investment is the only company belonging to a listed corporate Group that focuses on alternative investment.

Meanwhile, the major alternative multi-strategy funds manager Blackstone, KKR and Carlyle are listed on stock markets in Europe and the United States. These are key players in industrial revitalization and also enjoy a great deal of social recognition and influence.

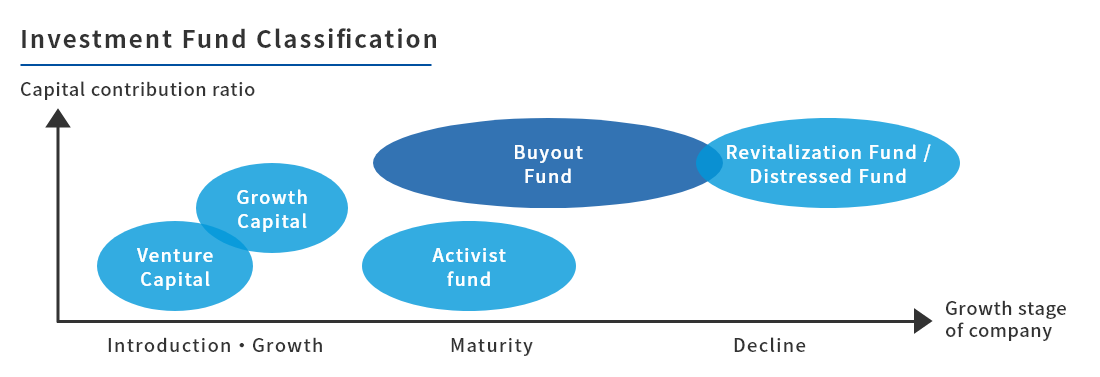

In Japan, unfortunately, buyout funds and other alternative investment funds have a low profile and are sometimes confused with so-called vulture funds and activist funds. Our buyout fund is involved in investing in small and medium-sized enterprises (SMEs) without successors, while our venture investment fund invests in and supports the growth of enterprises that will revitalize the real estate and logistics (transport and warehousing) industries, which are said to see the lowest level of IT capital input among industries compared with the United States.

Our mission is not only to support investees but also to convey to people in Japan the dynamism and excitement of alternative investment.

*Based on members of Japan Private Equity Association (JPEA)

AUM of

329.7billion yen

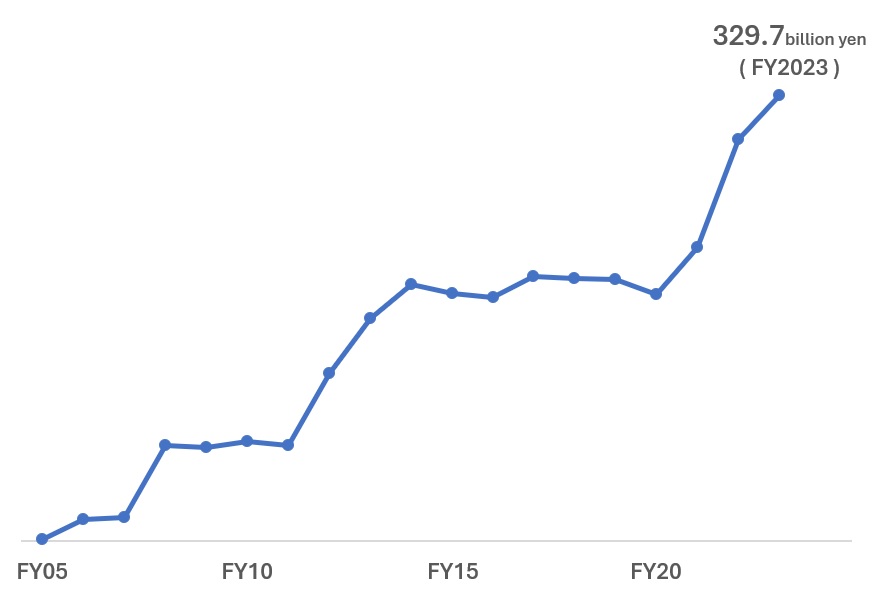

AUM of 329.7 billion yen

As of the end of December 2023, the Group's total assets under management (AUM) amounted to over 300 billion yen. Most of the growth in our AUM occurred before we were listed. This is because we managed and took over businesses that became insolvent due to dramatic changes in the external environment during the financial crisis. In fact, tough times brought opportunities.

From 2016, growth in AUM appears to have slowed temporarily because we completed divestments (either via sale or listing) from the funds formed and managed before we were listed. Going forward, we aim to expand AUM mainly through further asset acquisitions by Spring REIT, aircraft funds, renewable energy funds that invest in solar power generation facilities and buyout funds.

Profit Structure

with Upside Potential

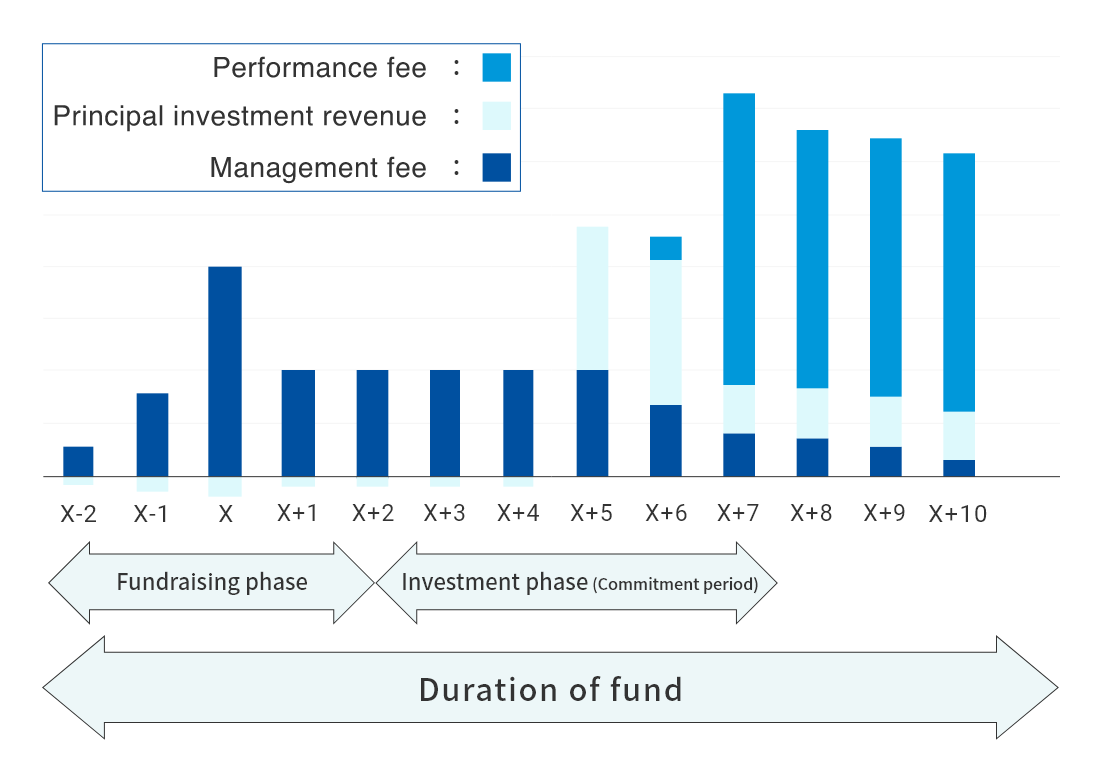

Our stable management fees underpin our revenue base. Performance fees and principal investment returns offer upside revenue potential.

The Group's revenue consists of (i) management fees, (ii) performance fees, and (iii) principal investment returns.

Our profit structure is characterized by the fact that management fees (i), which are stable revenue, underpin our revenue base, and there is significant upside potential from any performance fees (ii) and principal investment returns (iii) that arise.

①About Management fees

(i) Management fees are calculated by multiplying the total fund value and investment balance from formation to termination of the fund by a fixed rate and are recurring revenue based on a long-term contract. Since management fees provide a steady revenue stream until termination of the fund, we are unlikely to record a loss provided we keep our fixed costs within the scope of management fees, which is one of characteristics of the structure.

②About Performance fees

(ii) Performance fees are revenue earned by the fund manager depending on the actual returns of the fund managed. The timing of success fees depends on the external environment, including the implementing and exiting of investments but, as a general rule, performance fees tend to be recorded mostly in the second half of the fund period.

③About Principal investment revenue

(iii) Principal investment revenue is the income we earn as a return on our own investments in the funds we manage. The funds we manage make individual portfolio company transfers or let them listed for Exit. Whenever a profit is generated from these Exits, it is recorded as income for our Company.

Investment Fund Classification