Mercuria Holdings

Aircraft Investment

Features of our Group's aircraft

investment strategy

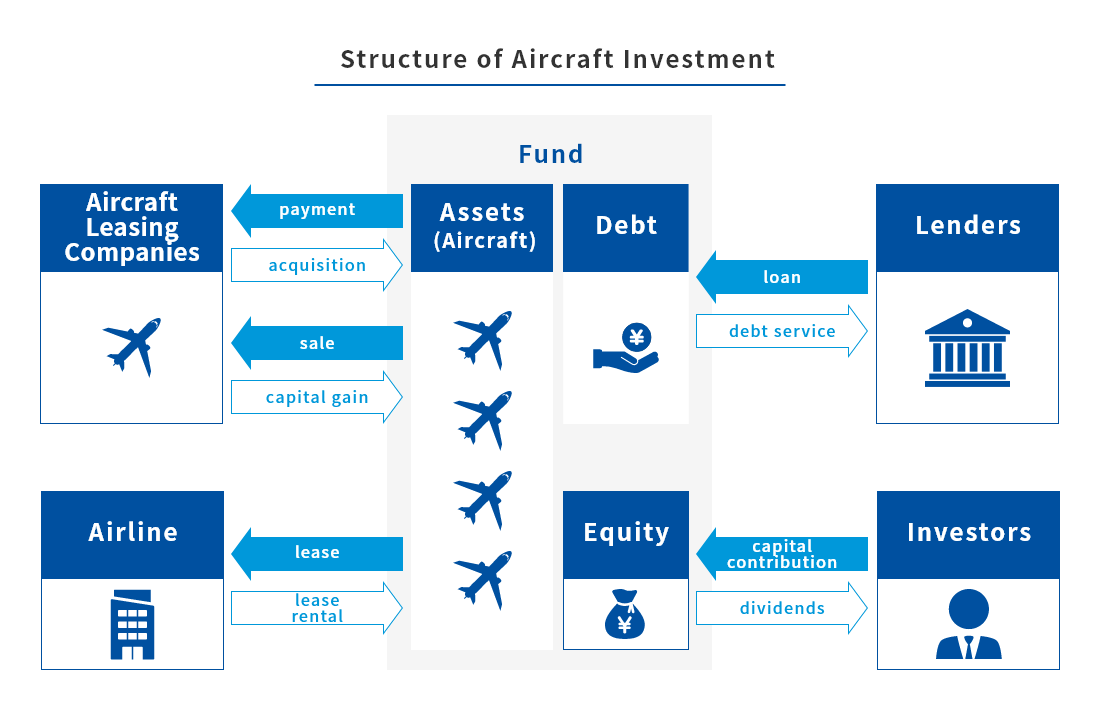

Unlike conventional aircraft investment focused on depreciation, we adopt an investment strategy of generating stable cash flows and returns in the medium and long terms based on income from leasing aircraft.

We aim for aircraft investment that meets the specific needs of Japanese institutional investors and, through the selection of aircraft assets and airline clients in collaboration with our strategic partners, we make investments that are comparatively low risk.

Post-COVID Aircraft Investment

Though severely impacted by the COVID-19 pandemic, aviation demand is expected to continue growing in the future alongside the expansion of the global economy.

Post-COVID-19, airlines around the world are reducing aircraft ownership due to the costs involved and the upward trend in the percentage of leased aircraft is accelerating. Since lessors will play an increasingly important role in the world of aviation finance moving forward, the opportunities involved in leasing aircraft through investment funds also look set to expand.